How Clearer Cash Flow Reporting Strengthens Your Business and Attracts Investors

- 03 Sep 2025

- Articles

Image by frimufilms on Freepik

Poor cash flow visibility is one of the fastest ways to lose investor interest. When investors cannot see how money moves through your business, uncertainty grows and hesitation follows.

Outdated reports and scattered spreadsheets that leave investors to guess the real financial picture are the problem.

But here's the solution: you turn uncertainty into trust with clear, in-actual-time data into inflows, outflows, and projections. That’s where cash flow projection software assists you in providing a transparent view that investors require to make assured and prompt choices.

Why Investors Care About Cash Flow Transparency

Profitable ideas alone don’t win investor confidence. They also want proof that your business can sustain operations without liquidity problems, manage growth effectively, meet obligations on time, and plan ahead for unexpected market changes.

Openness in cash flow gives them a clear view of how your business handles resources. Even strong companies can appear risky without that visibility, while detailed reporting of actual cash movement signals discipline, planning, and control.

The Link Between Clear Cash Flow Data and Risk Assessment

One of the primary considerations in an investment decision is risk. When cash flow visibility is poor, investors must:

-

Fill in gaps with assumptions.

-

Rely on incomplete or outdated data.

-

Reduce valuations to account for unknowns.

Precise data helps them:

-

See if revenue patterns align with expenses.

-

Understand payment term impacts.

-

Determine variations in cash flow based on the seasons.

-

Assess real liquidity risks.

Eliminating uncertainty speeds the decision-making process and increases the chance of favorable terms.

Driving Investor Confidence Through Real-Time Insights

Static financial statements give a snapshot of your business. Investors want a moving picture.

Immediate perspectives can transform how they perceive your company by providing:

Instant Awareness of Current Cash Position

Being able to show your exact liquidity at any given moment reassures investors that you are in control and aware of your financial standing.

Visibility Into Collections and Payables Trends

Patterns in receivables and payables tell a story about operational health. Highlighting these trends shows whether you are improving, stable, or facing delays.

Early Warning on Upcoming Obligations

Real-time monitoring reveals when significant expenses or liabilities are approaching, giving you and investors time to act before they become critical.

Evidence of Proactive Financial Management

Consistently tracking and adjusting based on up-to-date data signals that you are not waiting for problems to escalate before addressing them.

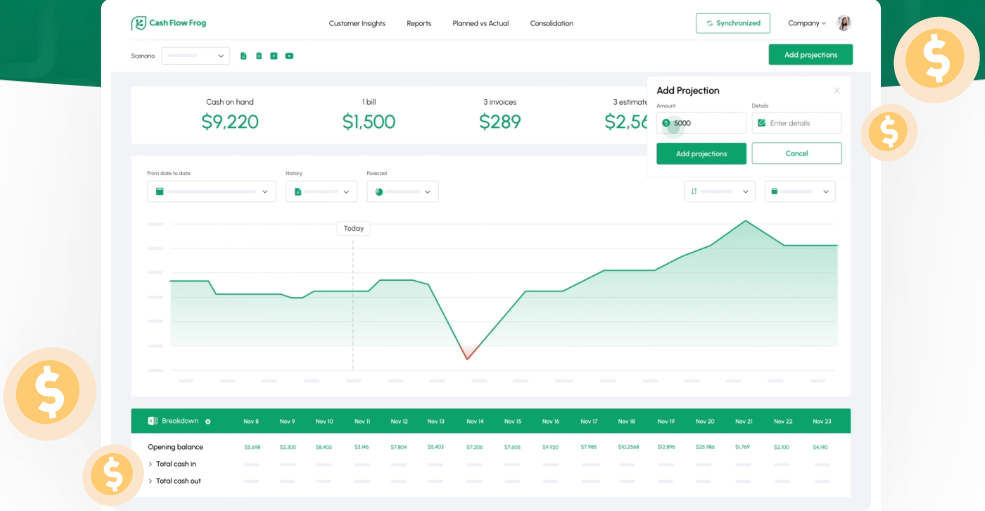

For instance, using Cash Flow Frog cash flow projection software, you can provide timely reports that reveal current performance and future expectations, reinforcing investor confidence in your readiness and decision-making.

(Cash Flow Frog - The Best Cash Flow Forecasting Software | Cash Flow Frog)

Impact on Valuation and Negotiation

Your financial reporting does more than fill investor folders. It influences the valuation of your business. Investors tend to feel unsafe when reporting is unclear or incomplete, which can mean:

-

Lower offers because they factor in higher perceived risk

-

Longer, drawn-out negotiations as they dig for clarification

-

Extra oversight requirements to protect their investment

On the other hand, strong cash flow transparency can work in your favor:

-

Boosts perceived business value by reducing uncertainty

-

Opens the door to higher funding offers

-

Speeds up deal timelines

-

Gives you a stronger position at the negotiation table

You can support your valuation with facts rather than simply projections when your data is reliable and easy to understand. That is what makes investors lean in.

Improving Investment Readiness Through Better Reporting

Being investment-ready is not just about the product or service. It also means you can present:

-

Clear past performance data

-

Accurate current financial status

-

Credible forecasts for the future

Specialized reporting tools help you:

-

Automate financial data collection

-

Continue to be accurate and consistent

-

Save time on investor updates

-

Show that you are operationally mature

Investors are more likely to commit when they see a business with streamlined, professional reporting processes.

Long-Term Benefits of Transparent Cash Flow Practices

Clear reporting is still necessary even after sponsorship. Constant clarity of cash flow:

-

Establishes lasting trust with investors

-

Supports easier future fundraising

-

Positions you as a lower-risk investment in your market

-

Improves internal decision-making and growth planning

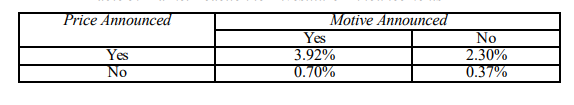

In capital markets, openness is more than a best practice; it’s a measurable driver of value. Research on market reactions to divestiture announcements shows that disclosing price and motive significantly strengthens investor response.

More disclosure drives stronger investor response. (Source: psu.edu)

Providing numbers and context earns stronger investor reactions; the same applies to cash flow reporting.

Final Thoughts

Investors' decisions are influenced by the quality of the information they receive. Your company becomes an investment-ready potential when there is clear cash flow transparency, rather than a perceived risk. You can enhance your financial management and provide investors with the necessary information by utilizing solutions like Cash Flow Frog cash flow projection software.

A better negotiating position, more investor trust, and a basis for long-term growth are the results.

Show investors the clarity they need. Message us to start building your investor-ready cash flow reports today.